Many of you know about my first quarter review of the companies of my watchlist. In it, I ran my stock purchase criteria on the entirety of my watchlist, just to see what companies looked like appealing investments today. I’m sure many of you noticed that there was one growth stock still on my list, Facebook Inc (FB). Some of you may remember that I’ve analyzed one growth stock before, PCLN, but that was a long time ago. I think it’s high time I look at another one, don’t you?

Quick Background:

From Scottrade:

Facebook, Inc. is a social networking website company. The Company provides Facebook’s websites and mobile applications enabling customers to stay connected with their friends and family. The Company’s business focuses on creating value for users, marketers, and developers. The Company supports developers to build, grow, and monetize mobile and web applications. The Company’s products include Facebook, Messenger, and Instagram. [Facebook’s] mobile app and website enable people to connect, share, discover, and communicate with each other on mobile devices and personal computers. Messenger, a mobile-to-mobile messaging application is available on iPhone Operating System (iOS) and Android phones. Instagram is a mobile application and website that enable people to take photos or videos, customize them with filter effects, and share them with friends and followers. The Company’s subsidiaries include Wit.ai, Inc., a voice-recognition company, and QuickFire Networks, a video-compression company.

Most of you know of FB through using it, or through movies like in “The Social Network” (great movie BTW). As a result, I’ll skip the details. Facebook was launched on February 4, 2004 as a social hub for Harvard students. It grew exponentially, and on May 17, 2012, FB went public in one of the largest and most sought-after IPOs in history. The company is based in Menlo Park, California, and is still headed by its founder, Mark Zuckerberg.

FB’s main competitors are Google Inc (GOOG/GOOGL), Yahoo! Inc (YHOO), and Twitter Inc (TWTR).

For more basic information, check out the company’s website and the 2013 annual report.

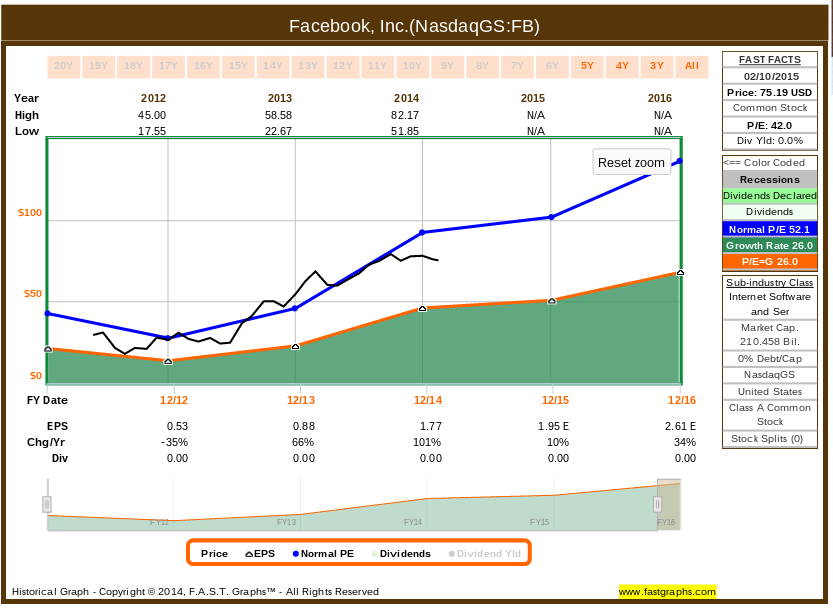

Fun fact: An investment of $10,000 on the IPO date of 5/18/2012 would be worth $25,402.19 today. This yields a annual rate of return of 41.3%. (Source: FAST Graphs)

Investment Criteria:

Since FB isn’t our standard dividend growth stock, we have to use our special growth stock screening criteria on it.

- I may only invest in technology companies in sub-sectors I understand (usually software): Yes

- The company must have a ‘narrow’ or better economic moat, based on Morningstar’s judgment: Yes (Wide)

- The company must have a quality rating of ‘B’ or better (‘A’ or better preferred), according to S&P’s credit ratings: Unknown (Not Rated)

- Earnings must be on a consistent and significant uptrend since going public or 5 years, whichever is shorter: Yes

- FAST Graphs must show undervaluation based on the Normal P/E ratio (the blue line): Yes

- Expected return is 8% or more over the next 5 years, according to FAST Graphs: Yes (23.59%)

Other Bonus Ratings:

- S&P Capital IQ: 4-star Buy

- Scale is 1-5, 1 being ‘strong sell’, 5 being ‘strong buy’

- Thompson Reuters StockReport: 6 (optimized score of 3)

- Scale is 1-10, 10 being best, 1 being worst

- Optimized scores weight insider trading and price momentum heavier than other criteria

- Value Line: 3 for safety; 3 for timeliness

- Scale is 1-5, 1 being best, 5 being worst

Financial Overview:

FB does not pay a dividend, since it is still in the growth stage and chooses to reinvest earnings into its businesses. Shares outstanding have increased from 2.318 billion at the IPO to 2.799 billion currently. I don’t find this surprising, due to tech companies liking to buy small companies with stock. And we also can’t forget that FB employees still own stock with varying vesting schedules, which they may sell on the open market to diversify. I don’t find this concerning. The company has no debt and has yet to split.

The company currently has a P/E ratio of 70.4, which is a bit high for a tech company, but not insane. Morningstar states that FB’s one-year forward P/E ratio is 30.8, which implies steady earnings growth. FB’s gross (82.73%), operating (40.06%), and net profit (23.58%) margins all comfortably exceed the peer group’s averages of 46.77%, 28.05%, and 21.34% respectively.

Over the next 5 years, FB is expected to grow earnings 31.0%, with a 5 year estimated total return of 21.9%. Compared to GOOGL (8.5%), YHOO (-14.6%), and TWTR (36.3%), FB will do quite well. TWTR is expected to do well due to being much smaller than FB. Granted, its small size implies higher risk as well as higher reward, so I consider FB the safest bet of the peer group.

Risk Factors:

Quoting from Morningstar (full report PDF is linked), since they can say it better than I can:

Although the revenue opportunity for Facebook is large, the company faces several risks that could ultimately prove our investment thesis to be overly optimistic. First, regulators may prevent the company from tracking its users. Significant regulatory action could detract from the value of its advertising platform. Second, excessive advertising or privacy fears could lead to a mass exodus of users. Other social networks (for example, MySpace, owned by News Corporation) have experienced declines. Lastly, if agencies and advertisers experience a permanent lack of visibility into advertiser return on investment, Facebook’s advertising opportunity may be significantly constrained…

The concern about capital allocation becomes even more paramount because Zuckerberg controls about 57% of the voting shares of the company. In 2012, the company acquired Instagram, a social networking site for sharing photos. Although the purchase only represented approximately 1% of the value of Facebook, it has been reported that the deal happened with very little involvement from the board of directors. If Zuckerberg loses discipline in allocating the company’s capital, there can be no guarantee that any such mechanism would prevent the company from destroying shareholder value.

Some good SeekingAlpha articles can be found here (bearish), here (bullish), here (bearish), and here (bullish).

Final conclusion:

As you can see, FB meets all of my criteria for purchase. Granted, we don’t know the quality ranking, but the lack of debt and higher margins than competitors assuage any fear that caused. And seriously, I recommend you look at the Morningstar report I linked above. It explains a lot why I like the name to begin with. FB has an absolutely massive user base, many of which will never leave because every single friend and family member also has an account. And because everyone and their cat has an account, that data that users willingly give up becomes very, very valuable to advertisers and marketing people. And since 900 million people are daily active users … that’s a lot of data to sell. FB is also making great inroads into mobile, especially after the acquisitions of Instagram and Whatsapp. And look how FB has improved over the years, as opposed to sites like Myspace, Friendster, etc. Of course, there’s nothing stopping FB from going the same way. But FB has too much of a hold on the common psyche that I just don’t see it collapsing any time soon. Hence, I consider FB a buy.

Would you consider investing in a growth company like FB? Also, how can I improve future analyses?

Disclosure: None

All data is accurate as of market close, 02/11/2015. My stock analysis archive page has been updated accordingly. Please read my disclaimer here before choosing to invest. Company logo image source is available here. Data source is FAST Graphs or company materials, unless otherwise indicated.

6 Comments

Facebook is a definitely interesting tech company and I always want to put my hands on but that high PE ratio always scares me as a dividend investor. I will have keep my eyes on.

Thanks for sharing great analysis.

BeSmartRich

BeSmartRich recently posted…Net Worth Update- January 2015 +7.1%

Yeah, I can see what you mean. I personally don’t feel a high P/E means all that much in a vacuum, especially for a young high-growth company. That’s why I rate it according to historical P/E rather than the “official” one, which does indicated a slight undervaluation. But hey, different strokes and all that

To me, it seems FB has trouble converting their massive user base into a real diversified business, for better or worse depending if we’re users and/or investors! That’s why I don’t feel like putting my trust in it for now.

That’s why I don’t feel like putting my trust in it for now.

DivGuy recently posted…Is Telus (T.TO) Done Growing Yet?

I do tend to agree with you, but I am not discouraged at their progress. I think they’re taking the right steps without sacrificing user engagement and happiness, which bodes well. FB is a growth stock, so it’s essentially a bet as to whether you trust them or not to succeed.

I don’t care about growth nor how popular a web site FB is. It can all go away in a matter of months as a new “something” appears online. Until they pay a dividend I won’t even consider FB.

DivHut recently posted…Regret Is My Motivator

To each their own.